Chinese Smartphone Makers Exploit Apple AI Delay to Gain Ground in China

Huawei, Xiaomi, Oppo, Vivo and Honor roll out iPhone-migration tools and AI features as Apple’s “Apple Intelligence” remains stalled in China

Chinese smartphone makers are mounting a coordinated push to attract former iPhone users, leveraging Apple’s delayed rollout of AI features in China to gain market share.

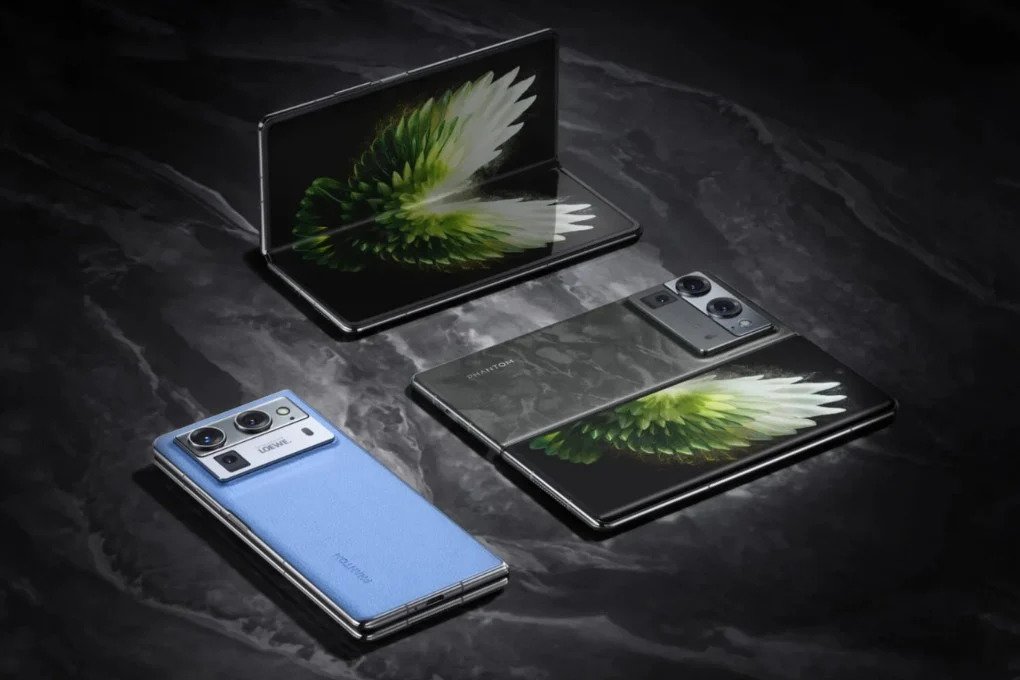

Industry leaders including Huawei, Xiaomi, Oppo, Vivo and Honor have introduced tools this year designed to ease migration from iOS — along with new AI-powered features aimed at convincing high-end consumers to switch.

The push comes as China’s regulators delayed approval for the rollout of Apple’s generative-AI features, widely dubbed “Apple Intelligence,” creating a window of opportunity for Chinese vendors.

Oppo, for instance, now offers AI capabilities such as smartphone-enabled spending trackers and gym-equipment guidance; Honor has released a new “Device Clone” app that transfers photos, messages and contacts by scanning a QR code — and claims that 37 per cent of buyers of its flagship Magic V5 swapped from Apple gear.

Market data underscores the shift.

In the third quarter of 2025, no single company held more than 20 per cent of China’s smartphone market.

Among the top five, each of the Chinese firms claimed between 13.6 per cent and 18.5 per cent, rivaling the share held by Apple.

Meanwhile, Apple saw its China iPhone sales slip by about 4 per cent in the quarter ending September, even though the launch of the iPhone 17 produced a 22 per cent rebound in monthly sales immediately after launch.

Analysts say the campaign by Chinese phone makers is far more than a marketing effort: it reflects a fundamental shift in consumer expectations.

Having missed early mover advantage in smartphone AI, Apple is now fighting to protect its foothold in its biggest overseas market.

As one analyst put it, China’s local vendors are “moving faster and with greater openness in AI development,” which could steadily erode Apple’s premium-segment dominance.

Still, for now, Apple remains a major force in China’s smartphone market.

But the accelerating pace at which domestic rivals are rolling out AI-driven features and iPhone-migration tools has emboldened Chinese vendors — and created a tangible risk that a growing number of consumers may abandon iOS entirely for feature-rich, AI-enabled alternatives from homegrown brands.

Industry leaders including Huawei, Xiaomi, Oppo, Vivo and Honor have introduced tools this year designed to ease migration from iOS — along with new AI-powered features aimed at convincing high-end consumers to switch.

The push comes as China’s regulators delayed approval for the rollout of Apple’s generative-AI features, widely dubbed “Apple Intelligence,” creating a window of opportunity for Chinese vendors.

Oppo, for instance, now offers AI capabilities such as smartphone-enabled spending trackers and gym-equipment guidance; Honor has released a new “Device Clone” app that transfers photos, messages and contacts by scanning a QR code — and claims that 37 per cent of buyers of its flagship Magic V5 swapped from Apple gear.

Market data underscores the shift.

In the third quarter of 2025, no single company held more than 20 per cent of China’s smartphone market.

Among the top five, each of the Chinese firms claimed between 13.6 per cent and 18.5 per cent, rivaling the share held by Apple.

Meanwhile, Apple saw its China iPhone sales slip by about 4 per cent in the quarter ending September, even though the launch of the iPhone 17 produced a 22 per cent rebound in monthly sales immediately after launch.

Analysts say the campaign by Chinese phone makers is far more than a marketing effort: it reflects a fundamental shift in consumer expectations.

Having missed early mover advantage in smartphone AI, Apple is now fighting to protect its foothold in its biggest overseas market.

As one analyst put it, China’s local vendors are “moving faster and with greater openness in AI development,” which could steadily erode Apple’s premium-segment dominance.

Still, for now, Apple remains a major force in China’s smartphone market.

But the accelerating pace at which domestic rivals are rolling out AI-driven features and iPhone-migration tools has emboldened Chinese vendors — and created a tangible risk that a growing number of consumers may abandon iOS entirely for feature-rich, AI-enabled alternatives from homegrown brands.