Thailand's Potential as 'Switzerland of ASEAN' for Global Investment

CP Group's CEO Highlights Thailand's Strategic Opportunities in a Bipolar World

At the Forbes Global CEO Conference in Bangkok, Suphachai Chearavanont, the CEO of Charoen Pokphand (CP) Group, proposed that Thailand could position itself as the 'Switzerland of ASEAN'.

Leveraging its neutral stance, the nation could attract global investments, particularly in technology, amidst the current bipolar geopolitical environment.

Suphachai emphasized Thailand's potential as a hub for finance and digital investments by implementing policies on foreign land ownership, business facilitation, and talent incentives.

He anticipates a stronger business ecosystem with upcoming digital transformation initiatives in multiple sectors.

The influx of foreign tourists projected to reach 40 million by 2025 and the 'China Plus One' strategy are expected to aid Thailand's growth.

Suphachai is confident in the government's economic vision driven by trade promotions.

He noted that in a world where China is a 'big brother' and the US a 'boss', Thailand is well-placed to engage both powers.

CP Group, with investments in 21 countries, seeks to expand globally, addressing digital transformation across all business areas.

Suphachai highlighted the need for a proactive corporate mindset and the importance of collaboration between education and industry for skill enhancement.

Similarly, Panote Sirivadhanabhakdi, CEO of Frasers Property, noted the rapid inflow of foreign capital into Southeast Asia.

He identified Thailand as a pivotal regional gateway benefiting from the China Plus One strategy.

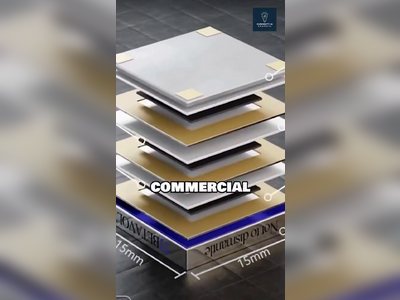

Frasers Property has developed One Bangkok, a landmark real estate project attaining LEED Platinum certification, emphasizing the shift towards integration and sustainability in real estate.

The company's growth to a US$8.6 billion valuation, using Singapore as a launch pad, exemplifies the potential of the region's robust tourism and manufacturing sectors.

Leveraging its neutral stance, the nation could attract global investments, particularly in technology, amidst the current bipolar geopolitical environment.

Suphachai emphasized Thailand's potential as a hub for finance and digital investments by implementing policies on foreign land ownership, business facilitation, and talent incentives.

He anticipates a stronger business ecosystem with upcoming digital transformation initiatives in multiple sectors.

The influx of foreign tourists projected to reach 40 million by 2025 and the 'China Plus One' strategy are expected to aid Thailand's growth.

Suphachai is confident in the government's economic vision driven by trade promotions.

He noted that in a world where China is a 'big brother' and the US a 'boss', Thailand is well-placed to engage both powers.

CP Group, with investments in 21 countries, seeks to expand globally, addressing digital transformation across all business areas.

Suphachai highlighted the need for a proactive corporate mindset and the importance of collaboration between education and industry for skill enhancement.

Similarly, Panote Sirivadhanabhakdi, CEO of Frasers Property, noted the rapid inflow of foreign capital into Southeast Asia.

He identified Thailand as a pivotal regional gateway benefiting from the China Plus One strategy.

Frasers Property has developed One Bangkok, a landmark real estate project attaining LEED Platinum certification, emphasizing the shift towards integration and sustainability in real estate.

The company's growth to a US$8.6 billion valuation, using Singapore as a launch pad, exemplifies the potential of the region's robust tourism and manufacturing sectors.