Upgrading digital infrastructure at the core of Krungsri’s plans

Krungsri (Bank of Ayudhya), Thailand's fifth-largest bank, is allocating 45 billion baht over three years to enhance its banking products and digital infrastructure.

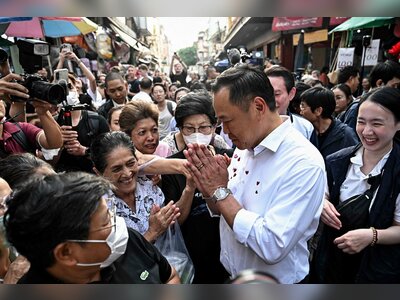

The investment, announced by President and CEO Kenichi Yamato, is part of Krungsri’s new plan for 2024-2026, focused on becoming a top sustainable bank in the region.

The spending includes improvements in operations, digital transformation, business growth, and environmental initiatives.

Yamato emphasized the importance of innovation and responding to customer needs, highlighting plans to expand sustainable finance for a wider range of clients, including SMEs and retail customers, and support their transition to lower-carbon operations.

Krungsri, in partnership with Mitsubishi UFJ Financial Group (MUFG), aims to be the preferred ASEAN regional bank, facilitating cross-border business for Thai and foreign investors, with an ASEAN network spanning most of the region.

Investments will continue in the bank’s digital transformation project, the Jupiter Project, to enhance its data and technology capabilities, supporting service improvement and sustainable growth. These efforts are aimed at solidifying Krungsri’s position in the market as a data-centric financial institution.

Following strong financial performance in 2023, including a 7.2% increase in net profit and low non-performing loans, the bank targets continued growth with a 3-5% loan expansion and specific financial benchmarks for 2024.

While Thailand’s economy is expected to recover gradually, challenges such as international economic uncertainties, financial tightening, and the risk of drought could slow progress.

The spending includes improvements in operations, digital transformation, business growth, and environmental initiatives.

Yamato emphasized the importance of innovation and responding to customer needs, highlighting plans to expand sustainable finance for a wider range of clients, including SMEs and retail customers, and support their transition to lower-carbon operations.

Krungsri, in partnership with Mitsubishi UFJ Financial Group (MUFG), aims to be the preferred ASEAN regional bank, facilitating cross-border business for Thai and foreign investors, with an ASEAN network spanning most of the region.

Investments will continue in the bank’s digital transformation project, the Jupiter Project, to enhance its data and technology capabilities, supporting service improvement and sustainable growth. These efforts are aimed at solidifying Krungsri’s position in the market as a data-centric financial institution.

Following strong financial performance in 2023, including a 7.2% increase in net profit and low non-performing loans, the bank targets continued growth with a 3-5% loan expansion and specific financial benchmarks for 2024.

While Thailand’s economy is expected to recover gradually, challenges such as international economic uncertainties, financial tightening, and the risk of drought could slow progress.