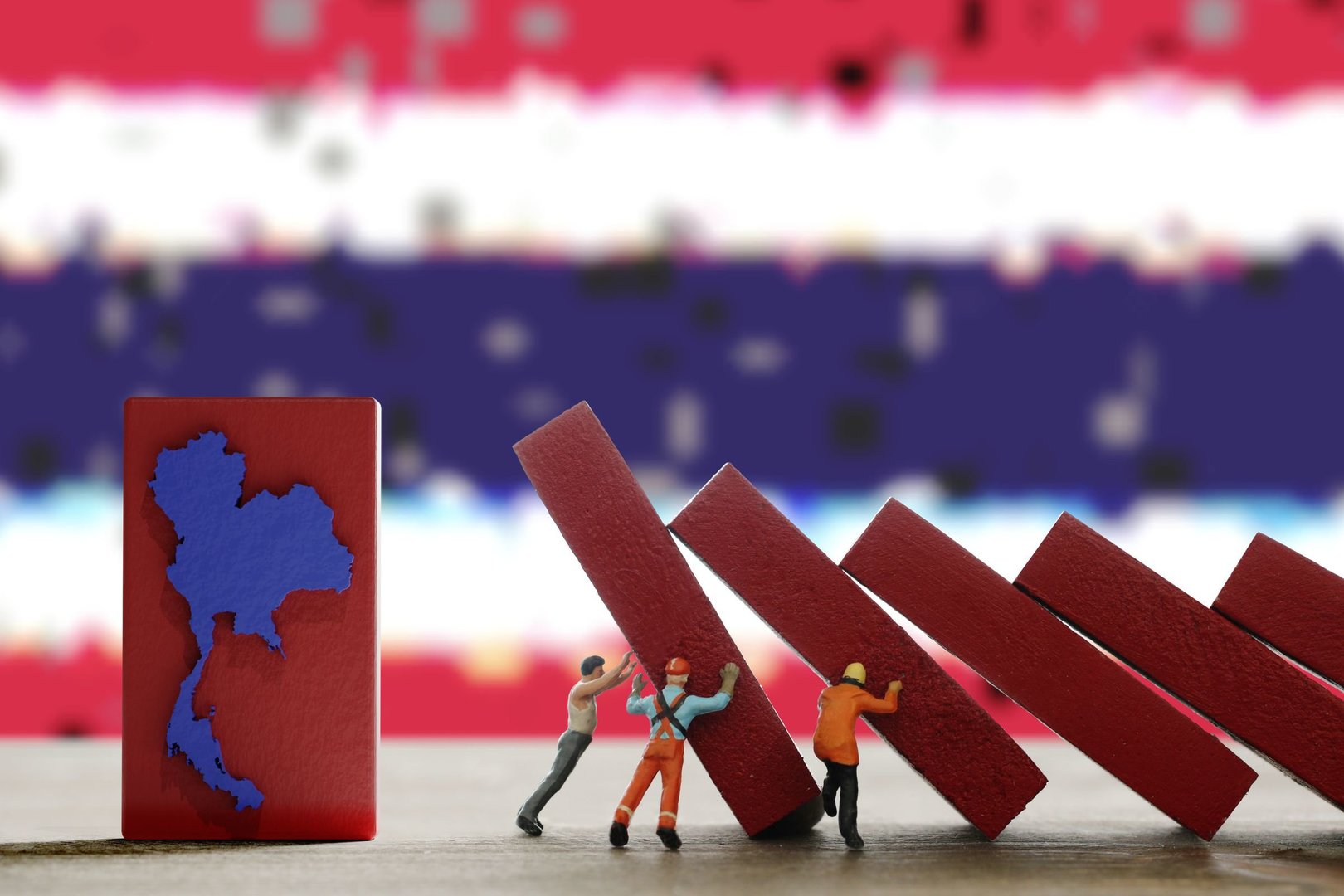

Thailand’s Economic Decline Deepens as Structural Challenges Earn It the ‘Sick Man of Asia’ Label

Once a regional growth leader, Thailand is now grappling with stagnation, mounting debt, demographic pressures and weakening key industries

Thailand’s economy is increasingly being characterised as the ‘sick man of Asia’ as its long-heralded dynamism falters under a host of structural headwinds and external pressures.

After decades as one of Southeast Asia’s fastest-growing economies, recent data and expert analysis show that the kingdom has stagnated: average annual growth has hovered near two percent over the past five years, far below its late-20th-century highs and trailing many of its regional peers.

This slowdown has coincided with a contraction in once-vital sectors such as tourism and manufacturing, an ageing population, and persistent weaknesses in domestic demand that have combined to sap economic resilience and investor confidence.

A confluence of demographic and macroeconomic trends underpins Thailand’s malaise.

The population is rapidly ageing, with birth rates at multi-decade lows and a growing share of residents over the age of sixty, straining public finances and reducing the labour force.

Household debt remains among the highest in the region, weighing on consumption and choking private investment.

Weak productivity growth and a manufacturing sector struggling to compete with lower-cost rivals such as Vietnam and Malaysia have further eroded Thailand’s traditional growth drivers.

As a result, domestic consumption — historically a pillar of expansion — has weakened, and inflation has occasionally turned negative, signalling soft demand across broad swathes of the economy.

External factors have exacerbated internal fragilities.

Export-oriented industries face volatility amid global trade uncertainty, including tariff pressures and competition from Chinese goods that have tightened profit margins and led to factory closures.

Tourism, once a reliable engine of growth, has shown signs of strain with declines in key source markets, contributing to weaker retail and hospitality performance.

At the same time, political instability and frequent changes in leadership have made long-term policy planning difficult, dampening business sentiment and delaying structural reform.

Observers warn that without bold policy shifts — including efforts to diversify the economy, revitalise manufacturing through technology and innovation, attract productive foreign investment, and encourage higher domestic consumption — Thailand could struggle to reverse its trajectory.

Several economists note that continued growth below potential, against a backdrop of ageing demographics and high debt, threatens to widen the gap between Thailand and its regional competitors.

After decades as one of Southeast Asia’s fastest-growing economies, recent data and expert analysis show that the kingdom has stagnated: average annual growth has hovered near two percent over the past five years, far below its late-20th-century highs and trailing many of its regional peers.

This slowdown has coincided with a contraction in once-vital sectors such as tourism and manufacturing, an ageing population, and persistent weaknesses in domestic demand that have combined to sap economic resilience and investor confidence.

A confluence of demographic and macroeconomic trends underpins Thailand’s malaise.

The population is rapidly ageing, with birth rates at multi-decade lows and a growing share of residents over the age of sixty, straining public finances and reducing the labour force.

Household debt remains among the highest in the region, weighing on consumption and choking private investment.

Weak productivity growth and a manufacturing sector struggling to compete with lower-cost rivals such as Vietnam and Malaysia have further eroded Thailand’s traditional growth drivers.

As a result, domestic consumption — historically a pillar of expansion — has weakened, and inflation has occasionally turned negative, signalling soft demand across broad swathes of the economy.

External factors have exacerbated internal fragilities.

Export-oriented industries face volatility amid global trade uncertainty, including tariff pressures and competition from Chinese goods that have tightened profit margins and led to factory closures.

Tourism, once a reliable engine of growth, has shown signs of strain with declines in key source markets, contributing to weaker retail and hospitality performance.

At the same time, political instability and frequent changes in leadership have made long-term policy planning difficult, dampening business sentiment and delaying structural reform.

Observers warn that without bold policy shifts — including efforts to diversify the economy, revitalise manufacturing through technology and innovation, attract productive foreign investment, and encourage higher domestic consumption — Thailand could struggle to reverse its trajectory.

Several economists note that continued growth below potential, against a backdrop of ageing demographics and high debt, threatens to widen the gap between Thailand and its regional competitors.