Thailand's Economic Landscape in May: Tourism Decline and Export Growth

In May 2025, Thailand experienced a downturn in tourism amidst sustained export growth, with notable fluctuations in private investment and production sectors.

In May 2025, Thailand's economic indicators reflected a complex landscape marked by a decline in tourism and a robust export sector, alongside stagnant private investment.

The tourism sector, particularly international arrivals, registered a significant downturn, with foreign tourist visits totaling 2.27 million, representing a 13.9% decrease compared to the same period last year and a 2.5% decline from April 2025, after seasonal adjustments.

In contrast, domestic tourism displayed resilience, experiencing a 1.9% year-on-year increase with 22.9 million domestic visitors in May, and a month-on-month rise of 3.0%, seasonally adjusted.

Despite challenges in tourism, Thailand's export sector reported growth for the 11th consecutive month.

The total value of exports reached USD 31.04 billion in May, reflecting an 18.4% increase year-on-year, the highest growth rate since March 2022.

Core export value, which excludes oil, gold, military goods and their related products, increased by 20.3%.

Leading export categories included canned and processed fruits, tapioca products, and canned seafood, showing growth rates of 24.9%, 15.5%, and 10.2% respectively.

However, some sectors experienced declines; exports of rice, rubber, and telecommunications equipment were notably affected.

Exports to major partners saw substantial gains, with the United States, China, and India recording increases of 35.1%, 28.0%, and 27.5%, respectively.

Conversely, Japan and the ASEAN-5 region experienced slight declines in Thai exports.

On the supply side, the agricultural sector indicated a year-on-year growth of 4.3%, mainly driven by higher output in key crops, although production of cassava, oil palm, and maize declined month-on-month.

The Agricultural Production Index showed a drop of 1.0% from April due to these variances.

Investment indicators in the private sector remained flat in comparison year-on-year.

However, investment in machinery and equipment surged by 36.2%, with a month-on-month increase of 6.5%, indicative of certain areas of growth.

Yet, new commercial vehicle registrations saw a downturn, falling by 10.9% year-on-year and 5.8% compared to April, suggesting a weakening business sentiment in logistics and transportation.

The Industrial Confidence Index fell to 88.1 in May from 89.9 in April, attributed to concerns over border tensions, declining agricultural prices, and potential hikes in US import tariffs.

Contrarily, the Purchasing Managers’ Index (PMI) improved to 51.2 from the previous month's 49.5, buoyed by an increase in export orders.

Thailand's inflation rate turned negative in May 2025, registering at -0.57%, with the core inflation rate at 1.09%.

Public debt levels remained within acceptable thresholds at 64.8% of GDP as of late April 2025.

Furthermore, the international reserves stood at USD 257.6 billion, indicating strong external stability to withstand global economic fluctuations.

On the global economic landscape, the Global Composite PMI for May indicated growth, rising to 51.2, although the Global Manufacturing PMI decreased to 49.6. The Global Services PMI, however, improved to 52.0, indicating a recovery in that sector.

Geopolitical tensions, including conflicts in regions such as the Middle East, and trade protectionist measures by the United States, continue to pose risks to broader economic stability.

In the financial markets, Thailand's equity market showed signs of recovery, particularly with strong activity from domestic retail investors.

As of June 23, 2025, individual investors recorded net purchases of 24.92 billion baht, sharply up from May's 11.83 billion baht.

Year-to-date figures reflected a total net purchase of 112.17 billion baht.

Foreign investments, while showing net purchases on the 23rd of 913.35 million baht, showed a negative overall position for June to date, though at a slower pace of decline than in the previous month.

In the bond market, foreign investors sold 1.32 billion baht on June 23 but maintained a net positive position year-to-date, highlighting a level of continued confidence in Thai government bonds amidst global monetary tightening.

The tourism sector, particularly international arrivals, registered a significant downturn, with foreign tourist visits totaling 2.27 million, representing a 13.9% decrease compared to the same period last year and a 2.5% decline from April 2025, after seasonal adjustments.

In contrast, domestic tourism displayed resilience, experiencing a 1.9% year-on-year increase with 22.9 million domestic visitors in May, and a month-on-month rise of 3.0%, seasonally adjusted.

Despite challenges in tourism, Thailand's export sector reported growth for the 11th consecutive month.

The total value of exports reached USD 31.04 billion in May, reflecting an 18.4% increase year-on-year, the highest growth rate since March 2022.

Core export value, which excludes oil, gold, military goods and their related products, increased by 20.3%.

Leading export categories included canned and processed fruits, tapioca products, and canned seafood, showing growth rates of 24.9%, 15.5%, and 10.2% respectively.

However, some sectors experienced declines; exports of rice, rubber, and telecommunications equipment were notably affected.

Exports to major partners saw substantial gains, with the United States, China, and India recording increases of 35.1%, 28.0%, and 27.5%, respectively.

Conversely, Japan and the ASEAN-5 region experienced slight declines in Thai exports.

On the supply side, the agricultural sector indicated a year-on-year growth of 4.3%, mainly driven by higher output in key crops, although production of cassava, oil palm, and maize declined month-on-month.

The Agricultural Production Index showed a drop of 1.0% from April due to these variances.

Investment indicators in the private sector remained flat in comparison year-on-year.

However, investment in machinery and equipment surged by 36.2%, with a month-on-month increase of 6.5%, indicative of certain areas of growth.

Yet, new commercial vehicle registrations saw a downturn, falling by 10.9% year-on-year and 5.8% compared to April, suggesting a weakening business sentiment in logistics and transportation.

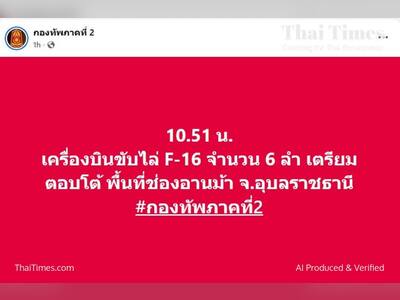

The Industrial Confidence Index fell to 88.1 in May from 89.9 in April, attributed to concerns over border tensions, declining agricultural prices, and potential hikes in US import tariffs.

Contrarily, the Purchasing Managers’ Index (PMI) improved to 51.2 from the previous month's 49.5, buoyed by an increase in export orders.

Thailand's inflation rate turned negative in May 2025, registering at -0.57%, with the core inflation rate at 1.09%.

Public debt levels remained within acceptable thresholds at 64.8% of GDP as of late April 2025.

Furthermore, the international reserves stood at USD 257.6 billion, indicating strong external stability to withstand global economic fluctuations.

On the global economic landscape, the Global Composite PMI for May indicated growth, rising to 51.2, although the Global Manufacturing PMI decreased to 49.6. The Global Services PMI, however, improved to 52.0, indicating a recovery in that sector.

Geopolitical tensions, including conflicts in regions such as the Middle East, and trade protectionist measures by the United States, continue to pose risks to broader economic stability.

In the financial markets, Thailand's equity market showed signs of recovery, particularly with strong activity from domestic retail investors.

As of June 23, 2025, individual investors recorded net purchases of 24.92 billion baht, sharply up from May's 11.83 billion baht.

Year-to-date figures reflected a total net purchase of 112.17 billion baht.

Foreign investments, while showing net purchases on the 23rd of 913.35 million baht, showed a negative overall position for June to date, though at a slower pace of decline than in the previous month.

In the bond market, foreign investors sold 1.32 billion baht on June 23 but maintained a net positive position year-to-date, highlighting a level of continued confidence in Thai government bonds amidst global monetary tightening.