Thailand’s Wealthiest Tycoon Emerges as Largest Shareholder in Kasikornbank

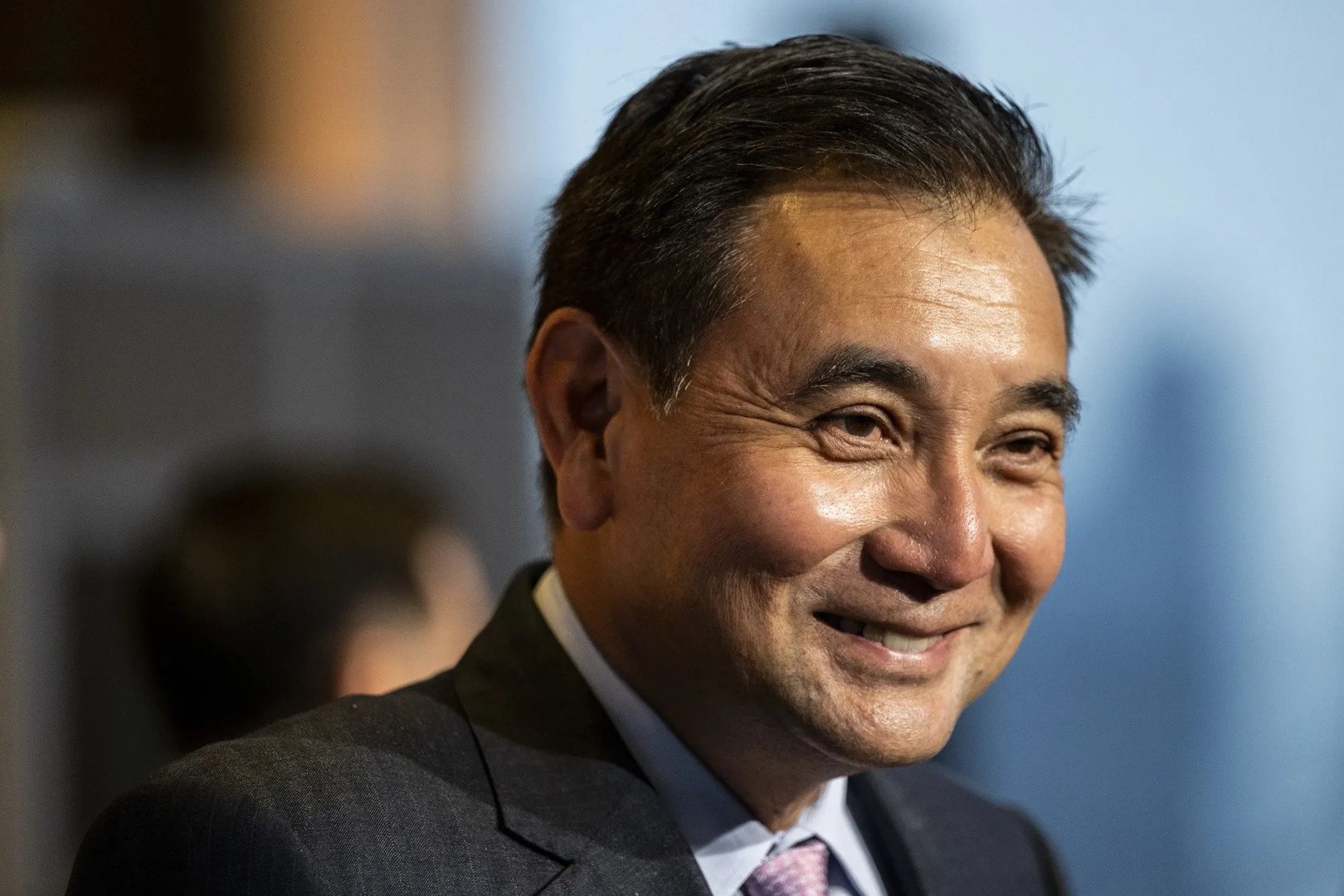

Strategic stake signals confidence in Thai banking sector as leading businessman deepens influence in major financial institution

Thailand’s richest businessman has become the largest shareholder in Kasikornbank, marking a significant development in the country’s financial landscape and underscoring strong private-sector confidence in Thailand’s banking system.

Regulatory filings and market disclosures show that the prominent tycoon increased his holdings through a combination of direct purchases and affiliated investment vehicles, lifting his stake above other major shareholders.

The move positions him as the bank’s top individual investor at a time when Thailand’s financial sector is navigating regional volatility and shifting global capital flows.

Kasikornbank, one of Thailand’s leading commercial lenders, plays a central role in corporate finance, small- and medium-sized enterprise lending, and digital banking services.

The institution has been advancing technology-driven services and expanding its regional footprint, particularly within Southeast Asia.

Market analysts interpret the increased stake as a long-term strategic investment rather than a short-term financial maneuver.

Thailand’s banking system remains well-capitalized and subject to strong regulatory oversight, with capital adequacy ratios and liquidity buffers that compare favorably with regional peers.

Shares in Kasikornbank recorded heightened trading activity following the disclosure, reflecting investor interest in the implications of the ownership shift.

Financial experts noted that while the tycoon’s expanded position enhances his influence as a shareholder, operational control remains with the bank’s management under established governance frameworks.

The development comes amid broader efforts to strengthen Thailand’s financial competitiveness, including digital transformation initiatives and regulatory modernization.

The banking sector has been adapting to evolving consumer behavior, rising fintech competition and tighter global financial conditions.

Observers say the investment highlights enduring confidence in Thailand’s economic fundamentals, including resilient domestic consumption, tourism recovery momentum and expanding regional trade ties.

The increased stake also reinforces the role of leading Thai business groups in shaping the country’s financial and corporate ecosystem.

Further disclosures are expected as reporting thresholds are triggered, but officials indicated that the transaction complies fully with securities regulations and existing ownership limits.

Regulatory filings and market disclosures show that the prominent tycoon increased his holdings through a combination of direct purchases and affiliated investment vehicles, lifting his stake above other major shareholders.

The move positions him as the bank’s top individual investor at a time when Thailand’s financial sector is navigating regional volatility and shifting global capital flows.

Kasikornbank, one of Thailand’s leading commercial lenders, plays a central role in corporate finance, small- and medium-sized enterprise lending, and digital banking services.

The institution has been advancing technology-driven services and expanding its regional footprint, particularly within Southeast Asia.

Market analysts interpret the increased stake as a long-term strategic investment rather than a short-term financial maneuver.

Thailand’s banking system remains well-capitalized and subject to strong regulatory oversight, with capital adequacy ratios and liquidity buffers that compare favorably with regional peers.

Shares in Kasikornbank recorded heightened trading activity following the disclosure, reflecting investor interest in the implications of the ownership shift.

Financial experts noted that while the tycoon’s expanded position enhances his influence as a shareholder, operational control remains with the bank’s management under established governance frameworks.

The development comes amid broader efforts to strengthen Thailand’s financial competitiveness, including digital transformation initiatives and regulatory modernization.

The banking sector has been adapting to evolving consumer behavior, rising fintech competition and tighter global financial conditions.

Observers say the investment highlights enduring confidence in Thailand’s economic fundamentals, including resilient domestic consumption, tourism recovery momentum and expanding regional trade ties.

The increased stake also reinforces the role of leading Thai business groups in shaping the country’s financial and corporate ecosystem.

Further disclosures are expected as reporting thresholds are triggered, but officials indicated that the transaction complies fully with securities regulations and existing ownership limits.