0:00

0:00

Berli Jucker to Acquire MM Mega Market Vietnam in $720 Million Deal

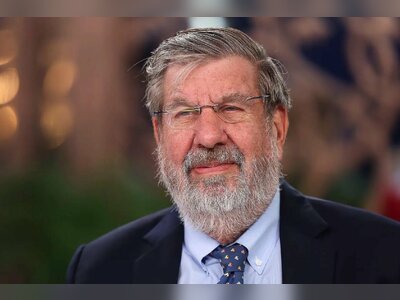

Thai conglomerate expands regional retail footprint with purchase from tycoon Charoen Sirivadhanabhakdi’s group

Thai conglomerate Berli Jucker Public Company Limited has agreed to acquire MM Mega Market Vietnam for approximately $720 million, in a transaction that will further consolidate its position in Southeast Asia’s fast-growing wholesale and retail sector.

The business is being sold by a group controlled by Thai billionaire Charoen Sirivadhanabhakdi, widely regarded as Thailand’s third richest individual.

The divestment forms part of a strategic review of regional assets, while enabling Berli Jucker to strengthen its presence in Vietnam’s expanding consumer market.

MM Mega Market Vietnam operates a nationwide network of wholesale centres and food distribution facilities, serving both business customers and individual shoppers.

The company has built a significant footprint in key urban areas, benefiting from Vietnam’s rising middle class and increasing demand for modern retail formats.

Berli Jucker, which is affiliated with TCC Group, said the acquisition aligns with its long-term strategy to expand across high-growth ASEAN economies.

The company has steadily diversified its operations across packaging, consumer goods and retail, with Vietnam viewed as a priority market due to strong demographic trends and sustained economic growth.

Market analysts note that Vietnam’s retail sector has remained resilient despite global economic headwinds, supported by domestic consumption and rapid urbanisation.

The transaction is expected to enhance Berli Jucker’s scale and distribution capabilities in the country, potentially creating operational synergies across supply chains and procurement networks.

The deal remains subject to customary regulatory approvals and closing conditions.

Upon completion, Berli Jucker is expected to integrate MM Mega Market Vietnam into its existing retail and wholesale operations, reinforcing Thailand’s growing corporate investment footprint in the region.

For Charoen’s business empire, the sale represents a portfolio reshaping rather than a retreat from regional investment, with the tycoon’s diversified holdings continuing to span beverages, real estate, and retail across Asia.

The business is being sold by a group controlled by Thai billionaire Charoen Sirivadhanabhakdi, widely regarded as Thailand’s third richest individual.

The divestment forms part of a strategic review of regional assets, while enabling Berli Jucker to strengthen its presence in Vietnam’s expanding consumer market.

MM Mega Market Vietnam operates a nationwide network of wholesale centres and food distribution facilities, serving both business customers and individual shoppers.

The company has built a significant footprint in key urban areas, benefiting from Vietnam’s rising middle class and increasing demand for modern retail formats.

Berli Jucker, which is affiliated with TCC Group, said the acquisition aligns with its long-term strategy to expand across high-growth ASEAN economies.

The company has steadily diversified its operations across packaging, consumer goods and retail, with Vietnam viewed as a priority market due to strong demographic trends and sustained economic growth.

Market analysts note that Vietnam’s retail sector has remained resilient despite global economic headwinds, supported by domestic consumption and rapid urbanisation.

The transaction is expected to enhance Berli Jucker’s scale and distribution capabilities in the country, potentially creating operational synergies across supply chains and procurement networks.

The deal remains subject to customary regulatory approvals and closing conditions.

Upon completion, Berli Jucker is expected to integrate MM Mega Market Vietnam into its existing retail and wholesale operations, reinforcing Thailand’s growing corporate investment footprint in the region.

For Charoen’s business empire, the sale represents a portfolio reshaping rather than a retreat from regional investment, with the tycoon’s diversified holdings continuing to span beverages, real estate, and retail across Asia.