Man Receives Parking Ticket 38 Years After Offense: ‘City Officials Said It’s Legitimate’

Woman Receives Gift Card for Christmas – Discovers It Is ‘Worth’ 63,000,000,000,000,000 Pounds

Red Lotus Sea Draws Global Attention After Lisa Showcases Thailand’s Iconic Bloom

Thailand Signals Opportunity After U.S. Court Orders Tariff Review Under Trump Framework

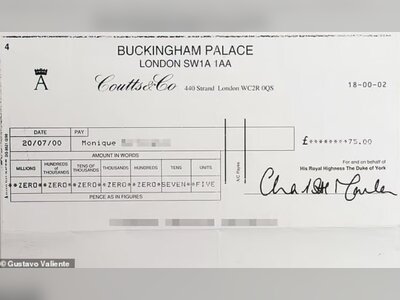

I Gave Andrew a Nude Massage Inside Buckingham Palace

Former UK Ambassador Peter Mandelson Arrested in Connection with Jeffrey Epstein

Thailand Prepares for Economic Impact as US Adopts Flat 15% Import Tariff

Thailand Earns Place Alongside Nordic Countries in Global Liveability Rankings

Thailand and Israel Advance Strategic Partnership at 6th Development Dialogue

Thailand to Raise Passenger Departure Fees from June in Airport Funding Overhaul

Thailand’s Crude Oil Imports Climb in January Amid Refinery Demand Rebound

MotoGP Confirms Full 2026 Thailand Grand Prix Schedule at Buriram

T.S. Lines to Join China–Thailand NT8 Shipping Service in Regional Expansion Move

Gen Natthaphon Says Not Contacted for New Cabinet Post, Calls for Permanent Fence at Khlong Luek–Thmor Dar Border

U.S. Pauses Immigrant Visa Processing for Cambodia and Thailand, Confounding Experts

Thailand’s BOI Endorses Over Ten Billion Baht Initiative to Establish First Humanoid Robot Parts Manufacturing Hub

Saskatchewan Seeks Expanded Post-Secondary Partnerships in the Philippines and Thailand

Thailand Sees Travel Surge as Chinese Tourists Return in Force

UAE Joins Global Airfare Surge as Eid Al Fitr Travel Drives Prices Higher

Thailand Faces Rising Competitive Pressure as Vietnam Gains Economic Momentum

Bridgeman Secures Maiden PGA Tour Victory at Riviera as Thitikul Triumphs in Thailand

Thai Meteorological Department Dismisses Rumours of 6.5-Magnitude Quake, Confirms No Impact from Malaysia Tremor

Record Prize Purse Announced for 2026 Honda LPGA Thailand as Player Payouts Detailed

Mark Zuckerberg Testifies in Trial Over Social Media's Impact on Children's Mental Health

Mexican Military Kills CJNG Leader Nemesio Oseguera Cervantes as Violence Erupts Across Jalisco

Thailand Ranked Among World’s 20 Most Liveable Countries for 2026

Thailand Confirms Jomtien Beach Safe for Swimming After Intensive Water Quality Review

Thailand Secures Limited Relief as US Tariff Decision Eases Pressure on Exports

South Korea Overtakes Regional Rivals to Become Japan’s Top Source of Record Tourist Arrivals

Thailand Intensifies Nationwide Gun Control Measures Following Security Review

Thailand Raises 2026 Economic Growth Forecast on Tourism and Export Momentum

Thailand Raises Passenger Service Charges at Six Major International Airports

Thailand’s Pivotal Election Marks Generational Shift as Young Progressive Leader Leads Polls

Thailand’s Cannabis Policy in 2026: From Liberalisation to Tighter Medical Oversight

Report Alleges Russia Routing Chinese Drones Through Thailand to Bypass Sanctions

OpenAI CEO Sam Altman praises the rapid progress of Chinese tech companies.

New electric vehicle charging service eliminates waiting times

North Korea's capital experiences a significant construction boom with the development of a new city district dubbed 'Pyonghattan'.

Why Phuket Remains Thailand’s Premier Nightlife Destination

Vandana Shiva reminding the world that Bill Gates did not invent anything.

Berli Jucker to Acquire MM Mega Market Vietnam in $720 Million Deal

Ex-Wife of ASOS Co-Founder Denies Involvement in Thailand Balcony Death

Asos Co-Founder Dies After Balcony Fall in Thailand

Round Two at Honda LPGA Thailand 2026 Delivers Tight Leaderboard Battle

Thai Authorities Move Swiftly After Virus Outbreak Kills 72 Captive Tigers

Thailand Launches Ambitious E-sports Development Strategy to Enhance Digital Economy

Thailand Welcomes Japanese Firms as Political Stability Boosts Investment Confidence

Thailand's Minor International Launches Singapore REIT and Plans Hong Kong IPO to Boost Global Expansion

Thailand's True Corporation Achieves Profit Stability, Enhancing Investor Confidence

Thailand Announces Global Conferences to Enhance Wellness and Sustainable Tourism