Thailand's SMEs Gain Support through 'SMES PICK-UP' Initiative

The Thai government launches a new scheme to bolster access to credit for small and medium enterprises amidst challenging economic conditions.

In a bid to support small and medium enterprises (SMEs) in Thailand, the Small and Medium Enterprise Development Bank of Thailand (SME Bank) has announced the launch of the 'SMES PICK-UP' program.

This initiative aims to assist approximately 3.2 million SMEs in gaining access to credit to facilitate business operation and expansion.

The program involves a credit guarantee mechanism that facilitates hiring and purchasing new pickup trucks, with a total budget of over 100 billion baht allocated for credit guarantees.

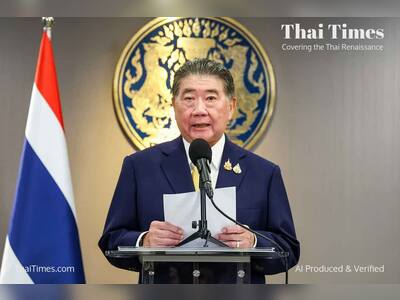

Sithikorn Direksunthorn, the General Manager of SME Bank, highlighted that the current economic environment presents significant challenges for SMEs, especially when it comes to acquiring loans.

Data from the Bank of Thailand indicates that commercial bank loans contracted by 0.4% in 2024, marking the most significant decline in 15 years.

Specifically, SME loans and hire-purchase loans have seen a reduction of 9.9%, contributing to an overall economic growth forecast of no more than 3%, adversely affecting businesses.

In response, the SME Bank's assistance plan for this year focuses on enhancing credit accessibility for SMEs by strengthening the credit guarantee framework in Thailand.

This includes risk management improvements and increasing financial support capabilities for SMEs through innovative credit guarantee schemes, benefiting over 3.2 million enterprises.

The credit guarantee budget of 110 billion baht is expected to stimulate 142 billion baht in credit circulation, allowing 165,000 SMEs to access loans, preserve 940,000 jobs, and generate an economic benefit estimated at 454.3 billion baht.

Key components of this initiative are:

SMES PICK-UP Loan Program: Allocating 10 billion baht for guarantees aimed at entrepreneurs seeking to purchase new pickup trucks for business operations.

The program aims to provide loans to 12,500 applicants.

This initiative not only assists business operators in acquiring new vehicles but also aims to revitalize the sluggish commercial vehicle market through state mechanisms and increased lending willingness from financial institutions, generating approximately 41.3 billion baht in economic benefits and preserving around 37,500 jobs.

Support for Vulnerable Business Owners: The program includes guarantees for micro and small enterprises and other vulnerable groups, featuring several sub-programs with a combined fund of 2 billion baht for new business starters, including a maximum guarantee of 20,000 baht per participant.

Low-Interest Loan Guarantees: In partnership with state financial institutions, a budget of 20 billion baht will be directed toward small enterprises with annual incomes not exceeding 2 million baht, offering interest rates starting at 3% per annum.

In the fiscal year of 2024, SME Bank reported guarantees totaling 53.738 billion baht, aiding 88,472 SMEs in securing loans, with micro-enterprises representing 90% of beneficiaries.

This resulted in an estimated 58.986 billion baht in credit injected into the financial system and the retention of 487,253 jobs.

Additionally, the debt rehabilitation measures initiated in 2022 have aided 18,489 borrowers, with a total debt value of over 11.872 billion baht, marking a historic peak since the establishment of the SME Bank.

Looking ahead, new measures are set to be implemented in 2025 targeting vulnerable SMEs with debt under 200,000 baht, featuring a 0% interest rate and a repayment plan designed to be manageable for borrowers.

The overarching mission of SME Bank remains to empower SMEs by acting as a 'Gateway' to connect them with funding opportunities, aiming for sustainable growth in a challenging economic landscape.

This initiative aims to assist approximately 3.2 million SMEs in gaining access to credit to facilitate business operation and expansion.

The program involves a credit guarantee mechanism that facilitates hiring and purchasing new pickup trucks, with a total budget of over 100 billion baht allocated for credit guarantees.

Sithikorn Direksunthorn, the General Manager of SME Bank, highlighted that the current economic environment presents significant challenges for SMEs, especially when it comes to acquiring loans.

Data from the Bank of Thailand indicates that commercial bank loans contracted by 0.4% in 2024, marking the most significant decline in 15 years.

Specifically, SME loans and hire-purchase loans have seen a reduction of 9.9%, contributing to an overall economic growth forecast of no more than 3%, adversely affecting businesses.

In response, the SME Bank's assistance plan for this year focuses on enhancing credit accessibility for SMEs by strengthening the credit guarantee framework in Thailand.

This includes risk management improvements and increasing financial support capabilities for SMEs through innovative credit guarantee schemes, benefiting over 3.2 million enterprises.

The credit guarantee budget of 110 billion baht is expected to stimulate 142 billion baht in credit circulation, allowing 165,000 SMEs to access loans, preserve 940,000 jobs, and generate an economic benefit estimated at 454.3 billion baht.

Key components of this initiative are:

SMES PICK-UP Loan Program: Allocating 10 billion baht for guarantees aimed at entrepreneurs seeking to purchase new pickup trucks for business operations.

The program aims to provide loans to 12,500 applicants.

This initiative not only assists business operators in acquiring new vehicles but also aims to revitalize the sluggish commercial vehicle market through state mechanisms and increased lending willingness from financial institutions, generating approximately 41.3 billion baht in economic benefits and preserving around 37,500 jobs.

Support for Vulnerable Business Owners: The program includes guarantees for micro and small enterprises and other vulnerable groups, featuring several sub-programs with a combined fund of 2 billion baht for new business starters, including a maximum guarantee of 20,000 baht per participant.

Low-Interest Loan Guarantees: In partnership with state financial institutions, a budget of 20 billion baht will be directed toward small enterprises with annual incomes not exceeding 2 million baht, offering interest rates starting at 3% per annum.

In the fiscal year of 2024, SME Bank reported guarantees totaling 53.738 billion baht, aiding 88,472 SMEs in securing loans, with micro-enterprises representing 90% of beneficiaries.

This resulted in an estimated 58.986 billion baht in credit injected into the financial system and the retention of 487,253 jobs.

Additionally, the debt rehabilitation measures initiated in 2022 have aided 18,489 borrowers, with a total debt value of over 11.872 billion baht, marking a historic peak since the establishment of the SME Bank.

Looking ahead, new measures are set to be implemented in 2025 targeting vulnerable SMEs with debt under 200,000 baht, featuring a 0% interest rate and a repayment plan designed to be manageable for borrowers.

The overarching mission of SME Bank remains to empower SMEs by acting as a 'Gateway' to connect them with funding opportunities, aiming for sustainable growth in a challenging economic landscape.