Viriyah Insurance Targets THB 42.5 Billion in Direct Premiums for 2025

The company aims for stable growth amidst economic challenges, with a focus on service enhancement and network expansion.

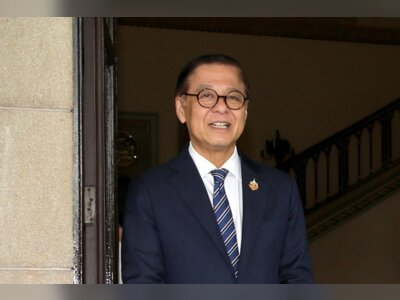

Viriyah Insurance Plc has announced its plan to achieve at least a 3.7% growth in direct premiums, targeting a total of 42.5 billion baht for the year 2025. This target includes an anticipated 37.5 billion baht from motor insurance premiums, reflecting a 3.3% increase, while non-motor insurance premiums are projected to reach 4.9 billion baht, marking an 11% rise, according to Managing Director Amorn Thongthew.

In outlining the company's strategic focus, Mr. Amorn emphasized three primary objectives: enhancing service quality, strengthening the ecosystem through the expansion of business partner networks, and improving personnel capabilities to better support all facets of insurance services.

During the previous year, Viriyah Insurance developed a comprehensive range of products encompassing various aspects of insurance, including motor, accident, health, and home insurance.

Mr. Amorn highlighted significant improvements made to customer service processes, including expedited and equitable claims services, enhanced post-sales service, and efficient underwriting protocols.

Viriyah operates over 160 branches of claim service centres and service points, strategically located in department stores across the country.

Innovative services introduced by the company include V-inspection for pre-insurance vehicle inspections, the VClaim on VCall platform for online claims, and V-roadside service, which provides 24-hour emergency assistance to policyholders regardless of their location.

Despite facing economic challenges and natural disasters, Viriyah Insurance reported a 2% increase in direct premiums for the year 2024, totaling 40.8 billion baht.

The company maintains its leadership position in the non-life insurance sector for the 33rd consecutive year, with a market share of 14.3%, including a core portfolio market share of 22.6% in motor insurance.

The organization reported a robust capital adequacy ratio of 220%, alongside total assets amounting to 73 billion baht, reflecting its ongoing financial strength and stability.

In outlining the company's strategic focus, Mr. Amorn emphasized three primary objectives: enhancing service quality, strengthening the ecosystem through the expansion of business partner networks, and improving personnel capabilities to better support all facets of insurance services.

During the previous year, Viriyah Insurance developed a comprehensive range of products encompassing various aspects of insurance, including motor, accident, health, and home insurance.

Mr. Amorn highlighted significant improvements made to customer service processes, including expedited and equitable claims services, enhanced post-sales service, and efficient underwriting protocols.

Viriyah operates over 160 branches of claim service centres and service points, strategically located in department stores across the country.

Innovative services introduced by the company include V-inspection for pre-insurance vehicle inspections, the VClaim on VCall platform for online claims, and V-roadside service, which provides 24-hour emergency assistance to policyholders regardless of their location.

Despite facing economic challenges and natural disasters, Viriyah Insurance reported a 2% increase in direct premiums for the year 2024, totaling 40.8 billion baht.

The company maintains its leadership position in the non-life insurance sector for the 33rd consecutive year, with a market share of 14.3%, including a core portfolio market share of 22.6% in motor insurance.

The organization reported a robust capital adequacy ratio of 220%, alongside total assets amounting to 73 billion baht, reflecting its ongoing financial strength and stability.