Thailand’s Economy Faces a Perfect Storm as U.S. Tariffs and Structural Weaknesses Weigh on Growth

External trade barriers, weak domestic demand, high debt and currency volatility compound long-standing economic challenges, tempering hopes for a strong rebound

Thailand’s economy is confronting a convergence of external pressures and deep-rooted vulnerabilities that threaten its near-term growth prospects.

While recent data point to modest expansion in November driven by stronger exports and investment, analysts and policymakers are warning that the economic outlook remains fragile as the country grapples with new U.S. tariffs, weak private consumption and persistent structural headwinds.

In November 2025, Thailand’s gross domestic product expanded as exports rose and investment increased, but private consumption declined and the country recorded a trade deficit as imports climbed, illustrating uneven performance across key sectors.

The Bank of Thailand now expects annual GDP growth to slow to around 2.2 per cent in 2025 and project even weaker expansion into 2026 amid rising downside risks.

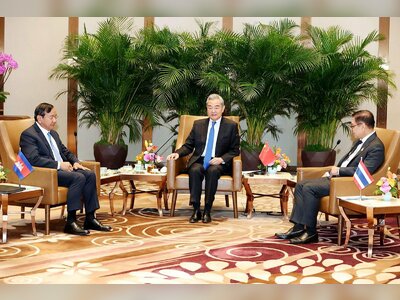

A central concern for Thai authorities and businesses is the imposition of higher U.S. tariffs on Thai exports, which account for nearly eighteen per cent of total shipments and play a pivotal role in sustaining growth in key manufacturing and agribusiness sectors.

These levies, which were negotiated throughout 2025, have been characterised by uncertainty and threatened to inflate costs for Thai producers and erode competitiveness in America’s vast consumer market.

The Bank of Thailand and private sector analysts have cautioned that the full effects of these trade barriers may be felt more sharply next year, potentially slowing export momentum and dampening investor confidence.

Thailand’s structural challenges extend beyond external trade dynamics.

High household debt has constrained domestic spending, limiting the contribution of consumption to growth.

Moreover, the Thai baht’s significant appreciation against the U.S. dollar has complicated export competitiveness and prompted the central bank to intervene heavily in currency markets to mitigate volatility.

Officials emphasised that while such interventions have softened fluctuations, they cannot address the underlying economic fragilities that make exporters vulnerable to exchange-rate shifts.

Long-standing structural issues, including an ageing population, labour market constraints and reliance on sectors such as tourism, continue to inhibit Thailand’s capacity to generate sustainable, broad-based growth.

Institutional analyses have identified these factors — alongside tariff pressures — as key drags on economic performance, underlining the need for comprehensive structural reform.

Despite these headwinds, there are signs of resilience: exports continued to expand modestly in late 2025, and the economy avoided sharper contraction.

Policymakers are also exploring targeted support measures, including loan guarantees to stimulate private credit and measures to bolster consumption during year-end festivities.

However, the combination of external pressures, domestic weaknesses and geopolitical uncertainties means Thailand’s economic trajectory will require careful calibration of policy responses and competitive adjustments to navigate the persistent perfect storm facing its economy.

While recent data point to modest expansion in November driven by stronger exports and investment, analysts and policymakers are warning that the economic outlook remains fragile as the country grapples with new U.S. tariffs, weak private consumption and persistent structural headwinds.

In November 2025, Thailand’s gross domestic product expanded as exports rose and investment increased, but private consumption declined and the country recorded a trade deficit as imports climbed, illustrating uneven performance across key sectors.

The Bank of Thailand now expects annual GDP growth to slow to around 2.2 per cent in 2025 and project even weaker expansion into 2026 amid rising downside risks.

A central concern for Thai authorities and businesses is the imposition of higher U.S. tariffs on Thai exports, which account for nearly eighteen per cent of total shipments and play a pivotal role in sustaining growth in key manufacturing and agribusiness sectors.

These levies, which were negotiated throughout 2025, have been characterised by uncertainty and threatened to inflate costs for Thai producers and erode competitiveness in America’s vast consumer market.

The Bank of Thailand and private sector analysts have cautioned that the full effects of these trade barriers may be felt more sharply next year, potentially slowing export momentum and dampening investor confidence.

Thailand’s structural challenges extend beyond external trade dynamics.

High household debt has constrained domestic spending, limiting the contribution of consumption to growth.

Moreover, the Thai baht’s significant appreciation against the U.S. dollar has complicated export competitiveness and prompted the central bank to intervene heavily in currency markets to mitigate volatility.

Officials emphasised that while such interventions have softened fluctuations, they cannot address the underlying economic fragilities that make exporters vulnerable to exchange-rate shifts.

Long-standing structural issues, including an ageing population, labour market constraints and reliance on sectors such as tourism, continue to inhibit Thailand’s capacity to generate sustainable, broad-based growth.

Institutional analyses have identified these factors — alongside tariff pressures — as key drags on economic performance, underlining the need for comprehensive structural reform.

Despite these headwinds, there are signs of resilience: exports continued to expand modestly in late 2025, and the economy avoided sharper contraction.

Policymakers are also exploring targeted support measures, including loan guarantees to stimulate private credit and measures to bolster consumption during year-end festivities.

However, the combination of external pressures, domestic weaknesses and geopolitical uncertainties means Thailand’s economic trajectory will require careful calibration of policy responses and competitive adjustments to navigate the persistent perfect storm facing its economy.